Sugary drinks cause weight gain and Increased risk Many diseases including diabetes.

gave Shows evidence That well-designed taxes can reduce sales of sugary drinks, force people to decide on healthier options and force manufacturers to scale back the sugar of their drinks. And although these taxes haven't been in place for long, there are already signs that they're making people healthier.

Now is the time for Australia to meet up with the remainder of the world and tax sugary drinks. As our latest Grattan Institute Reports shows, doing so could mean the typical Australian consumes around 700g less sugar every year.

Sugary drinks are making us sick.

The proportion of obese adults in Australia has tripled since 1980 to greater than 10%. 30%and diabetes is ours. The fastest growing Chronic condition. Costs to the health system and the economy are measured within the billions of dollars every year. But the best costs are borne by individuals and their families in the shape of illness, suffering and early death.

Sugary drinks are an enormous a part of the issue. The more of them we drink, the greater our risk. Weight gain, Development of type 2 diabetesand suffering Poor oral health.

These drinks don't have any real nutrition, but they're high in sugar. The average Australian uses 1.3 of the utmost really helpful amount of sugar every day. Sugary drinks are accountable for greater than 1 / 4 of our day by day sugar intake, greater than some other major form of food.

You could also be surprised by how much sugar you're consuming. Many 375 milliliter cans of sentimental drinks contain eight to 12 teaspoons of sugar, nearly the total day by day really helpful limit for an adult. Many 600ml bottles blow our entire day by day sugar budget, after which some.

Grattan Institute

The picture is even worse for disadvantaged Australians, who usually tend to be. Diabetes And obesityand who also eat probably the most sugary drinks.

A sugary drink tax works.

Fortunately, there's a proven strategy to reduce the damage attributable to sugary drinks.

greater than that 100 countries Tax sugary drinks, which covers a lot of the world's population. research shows that these taxes result in higher prices and fewer purchases.

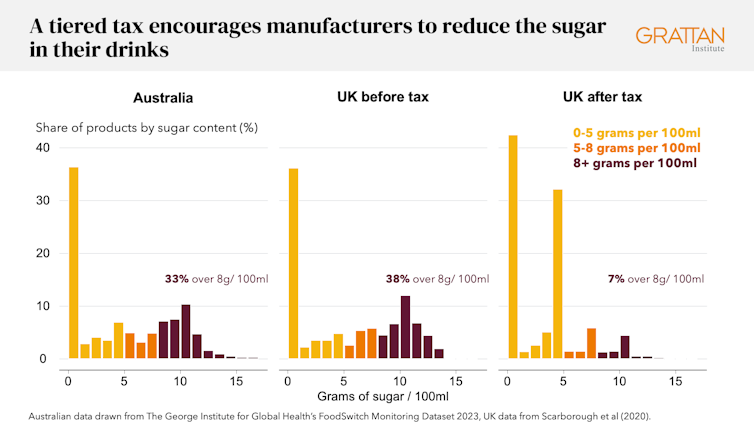

Some taxes are specifically designed to encourage manufacturers to alter their recipes and reduce the sugar of their drinks. Under these “tiered taxes,” there isn't any tax on beverages with low amounts of sugar, however the tax doubles or triples as the quantity of sugar increases. This gives manufacturers a robust incentive so as to add less sugar, so that they reduce their exposure to the tax or avoid paying it altogether.

This is one of the best final result of sugary drinks tax. This means the drinks develop into healthier, while taxes are kept to a minimum.

Eric McLean/Pixels

In countries with tiered taxes, manufacturers have reduced the sugar of their drinks. In the UK, the share of products above the tax threshold Decreased dramatically. In 2015, greater than half (52%) of products within the UK were above the tax threshold of 5g of sugar per 100ml. Four years later, when the tax took effect, that share dropped to fifteen percent. The variety of products with the very best sugar content – greater than 8g per 100ml – fell probably the most, falling from 38% to simply 7%.

The Australian drinks market today looks rather a lot just like the UK before the tax was introduced.

Grattan Institute

Health advantages may take longer to point out, but there are already promising signs that taxes are working. Obesity amongst primary school-aged girls has decreased. United Kingdom And Mexico.

Oral health has also improved, with studies reporting fewer children going to the hospital to have their teeth extracted. United Kingdomand reduced tooth decay In Mexico And Philadelphia.

one A study from the United States Cities with a sugary drinks tax had a big reduction in gestational diabetes.

The tax needs to be introduced to Australia.

Like successful taxes overseas, Australia should introduce a sugary drink tax that targets high-sugar drinks:

- Beverages with 8 grams or more of sugar per 100 ml will face a tax of $0.60 per liter.

- Beverages containing 5-8 grams needs to be taxed at $0.40 per liter.

- Beverages with lower than 5 grams of sugar needs to be tax-free.

That means a 250ml Coke, which has about 11g of sugar per 100ml, will cost $0.15 more. But in fact, consumers can avoid the tax by choosing a sugar-free soft drink or bottled water.

Grattan Institute Modeling shows that under this tiered tax, Australians drink about 275 million liters less sugary drinks every year, or the quantity of 110 Olympic swimming pools.

Teguh Sugi / Pexels

Taxation is expounded to health but in addition advantages the federal government budget. If introduced today, it will raise nearly half a billion dollars in the primary yr.

Interest groups equivalent to the beverage industry have fiercely resisted sugar-sweetened beverage taxes around the globe, issuing false warnings concerning the risks to poor people, the sugar industry and beverage manufacturers.

But our latest report shows that sugary drink taxes are easily introduced overseas, and none of those concerns should hold Australia back.

We actually cannot depend on industry guarantees to voluntarily reduce sugar. They have been. Weak And misleading, and Fail to stick.

It will take many policies and interventions to reverse the tide of obesity and chronic disease in Australia, but a sugary drinks tax needs to be a part of the answer. It's a policy that works, is straightforward to implement, and mostly Australian Support it.

The federal government must get serious about tackling Australia's biggest health problems and take this small step towards a healthier future.

Leave a Reply