When the predecessor to Medicare was established within the Seventies, dental care was ignored. Australians are still suffering the results half a century later.

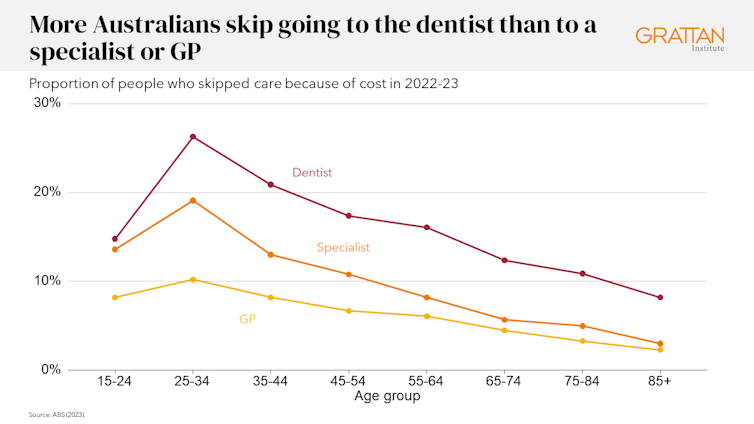

Patients pay far more for dental care than they do for other varieties of care.

More Australians are likely to delay or neglect dental care due to the fee in comparison with their peers in most affluent countries.

And as our dental health deteriorates, the fees proceed to rise.

Grattan Institute

Over the a long time, quite a few reports and inquiries have called for universal dental coverage to handle these issues.

Now, with the Greens Suggestion This and the Labor backbenchers support So, could it's time to finally put a mouthful on Medicare?

What's stopping us?

Australian Dental Association They say This idea is just too ambitious and too expensive, indicating that it's going to require more dental staff. He says the federal government should start small, specializing in essentially the most vulnerable population, initially the elderly.

Starting small is sensible, but ending small can be a mistake.

Dental costs usually are not just an issue for essentially the most vulnerable, or the elderly. greater than Two million Australians avoid dental care due to the fee.

greater than Four out of ten Adults often wait greater than a yr before seeing a dental skilled.

Grattan Institute

Bringing teeth into Medicare would require 1000's of recent dental staff. But it's going to be possible if there's a scheme. I step by step greater than ten years.

The major reason dental is just not included in Medicare is because it will cost billions of dollars. The federal government doesn't have that much money.

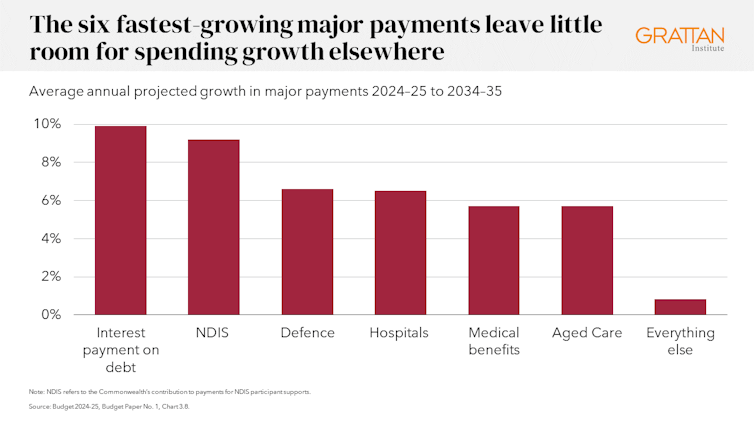

Australia has a structural budget problem. Government spending is growing faster than revenue, because we're relatively one. Low tax country with high service expectations.

The rising cost of health care is a significant contributor, with hospital and medical advantages among the many top six fastest growing co-pays.

The only difference is the structure. It is likely to increase Without major policy changes.

Grattan Institute

So, can now we have health look after all? We can do it. But we must accomplish that with smart decisions about dental care, and difficult decisions to extend income and reduce spending elsewhere.

Smart decisions a couple of recent dental plan

The first step is to avoid repeating Medicare's mistakes.

Medicare payments to personal businesses haven't drawn them to lots of the communities that need them most. Many rural and backward areas are bulk billing deserts with only a few GPs.

It is higher within the poorest areas. twice mental health problems within the wealthiest areas, but they receive half of the mental health services funded by Medicare.

As a result, government money is just not going where it's going to make the most important difference.

are about 80,000 There are visits to the hospital every yr for dental problems that would have been avoided with dental care. If little care is provided in underserved and rural communities, where oral health is most vulnerable, these numbers will remain high.

A good portion of recent investment should subsequently be earmarked for public dental services, targeting services to underserved areas.

Another problem with Medicare is that its payments often have little to do with the fee of care, or the impact of care on a patient's health.

To reduce costs, Medicare funding for dental care mustn't include cosmetic treatments and orthodontics. It ought to be based on efficient workforce models where dental assistants and therapists use all their skills – chances are you'll not at all times have to see a dentist.

Gustavo Fring/Pixels

Funding Model The patient's needs ought to be taken into consideration, their continued care ought to be rewarded, and there ought to be a hat On a per-patient basis.

Oral health ought to be measured and recorded, to be sure that patients and taxpayers are getting results.

Tough decisions to balance the budget

These measures will reduce the fee of the Greens' plan, which is difficult to estimate but could reach much higher. 20 billion dollars A yr later when it's going to be phased out. Instead, costs will almost fall. 7 billion dollars A yr

It will probably be a very good investment. But in the event you're apprehensive about where the cash will come from, there are good ways to pay for it.

Many reforms could reduce government health budgets without harming patients.

It is a waste of presidency funds. Pathology Test and Less cost effective Medicines.

In some hospitals, there are Excessive expenses And potentially harmful Low cost maintenance.

In the long term, investment prevention May reduce demand for health care. Oh Tax on sugary drinksFor example, will improve health while raising a whole bunch of tens of millions of dollars annually.

Such initiatives will help the federal government pay for more dental care. But the demand for health care will proceed to grow because the population ages and grow to be dearer. New treatments to achieve

That means a comprehensive strategy is required to fulfill the triple goals of balancing the budget, maintaining with the growing demand for health care, and bringing dental coverage into Medicare.

Lafayette Zapata Montero/Unsplash

There are not any easy solutions, but there are numerous options for reducing costs and increasing revenue without harming economic growth.

A collection of Australia's infrastructure and defense megaprojects More sensibly Could save billions of dollars every yr.

Revoking Western Australia's special GST funding deal – described “The worst Australian public policy decision of the 21st century” by economist Saul Eslick – will save one other. 5 billion dollars A yr

Reducing income tax breaks and opportunities for tax reductions – including reining in retirement tax breaks, reducing capital gains tax breaks, limiting negative gearing, and setting minimum taxes on trust distributions – can increase greater than 20 billion dollars A yr

Such major tax reforms offer economic advantages while making room for higher services akin to universal dental coverage.

No one likes spending cuts and tax hikes, but eventually they will probably be needed. Dental coverage is the one sweetener taxpayers need to just accept.

Leave a Reply